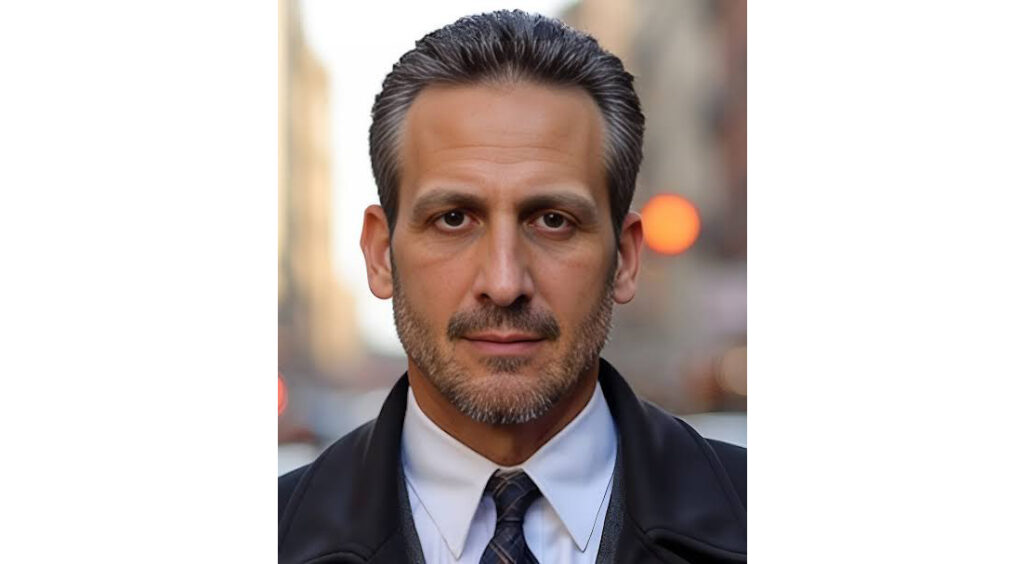

In the dynamic world of entrepreneurship, the decision to sell a company is as pivotal as the choice to start one. Joseph Safina’s latest book, Deal Mode: Mastering the Art of Selling Your Company, serves as a comprehensive guide for founders navigating this complex process. Drawing from his extensive experience in mergers and acquisitions, Safina offers invaluable insights into the art and science of executing successful business sale.

Understanding the Buyer’s Perspective

A central theme in Deal Mode is the importance of viewing the sale from the buyer’s standpoint. Safina emphasizes that founders must recognize the buyer’s motivations, concerns, and objectives. This empathetic approach enables sellers to tailor their pitch, address potential objections proactively, and highlight aspects of the business that align with the buyer’s strategic goals.

Preparing Your Business for Sale

Preparation is paramount. Safina outlines a meticulous process to ready a company for the market:

- Financial Transparency: Ensuring accurate and comprehensive financial records is crucial. Buyers will scrutinize earnings, liabilities, and cash flow.

- Operational Efficiency: Streamlining operations and documenting processes can make the business more attractive and reduce perceived risks.

- Legal Compliance: Addressing any legal issues, such as intellectual property rights or pending litigations, is essential to prevent deal disruptions.

- Team Stability: A competent and committed management team adds value, assuring buyers of continuity post-sale.

Valuation: Beyond the Numbers

While financial metrics are fundamental, Safina argues that intangible assets significantly influence valuation. Brand reputation, customer loyalty, and proprietary technology can command premium prices. He advises founders to articulate these value drivers effectively, demonstrating how they contribute to sustainable competitive advantage.

Negotiation Strategies

Negotiation is an art, and Deal Mode delves into tactics that can tip the scales in the seller’s favor:

- Know Your Walk-Away Point: Establishing clear boundaries prevents settling for unfavorable terms.

- Leverage Multiple Offers: Creating a competitive bidding environment can enhance deal terms.

- Understand Deal Structures: Familiarity with various deal components, such as earn-outs or stock options, allows for flexibility and creativity in negotiations.

- Maintain Professionalism: Emotions can cloud judgment. Approaching negotiations with composure ensures better outcomes.

Post-Sale Transition Planning

The sale’s success extends beyond the transaction. Safina underscores the importance of a well-thought-out transition plan:

- Knowledge Transfer: Facilitating the handover of critical information ensures operational continuity.

- Employee Communication: Transparent discussions with staff can alleviate uncertainties and maintain morale.

- Client Retention: Proactively engaging with key clients helps preserve relationships during the ownership change.

Embracing the Emotional Journey

Selling a business is not solely a financial decision; it’s an emotional journey. Founders often grapple with identity loss or fear of the unknown. Deal Mode addresses these psychological aspects, encouraging entrepreneurs to acknowledge their feelings, seek support, and focus on future opportunities.

Conclusion

Deal Mode: Mastering the Art of Selling Your Company is more than a transactional guide; it’s a strategic playbook for founders contemplating an exit. Joseph Safina combines practical advice with psychological insights, equipping entrepreneurs to navigate the complexities of selling their business with confidence and clarity. Whether you’re considering a sale now or in the future, this book offers a roadmap to achieving a successful and fulfilling transition.